Workers urged to make tax return claim as figures reveal 575,000 Irish people may be owed money

New figures revealed that a quarter of all PAYE taxpayers may be owed an average of over €730 for 2022 alone

An appeal has been issued to all Pay As You Earn (PAYE) workers to make a tax return online and claim the tax reliefs they are entitled to, after new figures revealed about a quarter of workers are overpaying their income tax.

According to new figures released by Finance Minister Jack Chambers, 330,000 PAYE workers overpaid their tax last year, while a further 245,000 workers are potentially due money back for overpaid tax from 2022. That means that around a quarter of all PAYE taxpayers in 2022 and 2023 may have overpaid tax.

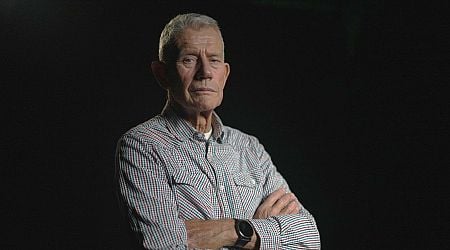

Labour’s finance spokesperson, Ged Nash TD, is calling on PAYE workers to make a tax return online and claim the tax reliefs they're entitled to.

READ MORE: November snow verdict as maps show exact date temperatures drop to freezing

READ MORE: 'I felt tired all the time - until I cut one common thing from my diet'

Deputy Nash said: “It is now clear from the figures issued to me from the Revenue Commissioners that around a quarter of all PAYE taxpayers in 2022 and 2023 may have overpaid tax. That’s a total of 245,000 in 2022 and 330,00 in 2023. The figures are remarkably similar from the corresponding data I received on the same date last year. This leads me to believe that it may be some of the same taxpayers who year-on-year, fail to do a return and get the cash back that they are owed.”

The file and return deadline for the 2023 tax year is Thursday, November 14 and all PAYE taxpayers can make a claim for as far back as 2020. The Louth Labour TD added: “Indications are that average funds of around €735 could be due to PAYE workers who overpaid their taxes in 2022 alone.

“Based on figures issued on Budget Day in October 2023, the then Finance Minister said around €180 million could be due in refunds for the 2022 tax year, in total. I have no doubt the pot of unclaimed money is similar for 2023.”

The Labour spokesperson on finance concluded: “It is high time Minister Chambers and the Revenue Commissioners ran a high-profile annual promotional campaign to encourage PAYE taxpayers to file tax returns and claim all the reliefs and credits workers are entitled to.”

Those who want to claim tax for the current year just need to simply log onto your revenue.ie account using your PPS number, date of birth and password. In order to claim additional tax credits, or declare additional income for a previous year, you must complete an Income Tax Return.

You can do this by following these steps:

- sign in to myAccount and complete or skip the Two-Factor Authentication (2FA)

- click the ‘Review your tax 2020 -2023’ link in PAYE Services

- select ‘Submit your Income Tax Return’ for the appropriate year.

All Pay As You Earn (PAYE) customers must complete an Income Tax Return to:

- claim additional tax credits, reliefs or expenses

- declare additional income

- obtain a Statement of Liability for the year

- claim refunds of any tax or Universal Social Charge (USC) overpaid

- confirm any liability of any tax or USC underpaid.

Join the Irish Mirror’s breaking news service on WhatsApp. Click this link to receive breaking news and the latest headlines direct to your phone. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like. If you’re curious, you can read our Privacy Notice.